Bonus Wages: Beyond Piece Wages - Francisco Paulo

The Facts About Do Bonuses Enhance Sales Productivity? - Harvard Business Uncovered

AboutPressCopyrightContact usDevelopersAdvertiseDevelopersTermsPrivacyPolicy & SafetyHow You, Tube worksCheck new features

AboutPressCopyrightContact usCreatorsMarketDevelopersTermsPrivacyPolicy & SafetyHow You, Tube worksTest new functions

All about Profit Force Review, Bonus From John Newman - A-Z

AboutPressCopyrightContact usDevelopersAdvertiseDevelopersTermsPrivacyPolicy & SafetyHow You, Tube worksCheck brand-new features

Motivating Salespeople: What Really Works

AboutPressCopyrightContact usDevelopersMarketDevelopersTermsPersonal privacyPolicy & SafetyHow You, Tube worksEvaluate brand-new functions

How 501c3 and Nonprofit Executive Compensation can Save You Time, Stress, and Money.

Privacy Policy - Terms - Disclaimer Trainee Loan Planner is a monetary training company and does not declare to offer financial recommendations on investment items. Re-financing federal loans triggers the borrower to lose access to income-based payment strategies along with the PSLF program. We might make payment from marketing partners when you click links on this site.

We do not provide tax or legal advice. At Student Loan Organizer, we hold editorial stability in high regard. This is why we work hard to ensure that our content provides total and unbiased details. Find out more about our editorial ethics policy. 2016 - 2021 TRAINEE LOAN ORGANIZER.

Top Guidelines Of Corporate Struggles: Who Has What Power When Push

When a C corporation's shareholder-employees are provided generous incomes and advantages, the corporation needs to be prepared to fight Internal Revenue Service claims that a few of the settlement payments are really disguised dividends, which were paid according to equip ownership. Particularly, the IRS will argue that the corporation can't justify payment amounts that surpass what's normally paid by comparable business to workers who supply comparable services.

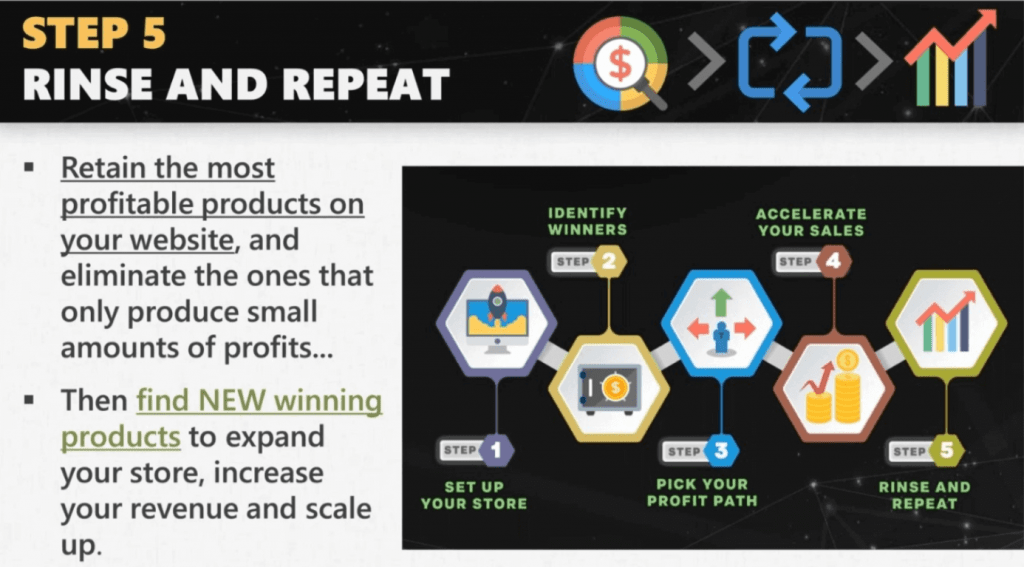

Kibo Code Review (2021 Quantum Model) And Awesome Bonus

When presumably excessive quantities of compensation and benefits are provided to an individual, the IRS will treat the excess as dividends. This can lead to double tax. Go Here For the Details is taxed when at the corporate level and again at the shareholder level when that earnings is paid out as dividends.

Indicators on Principles and practices of financial management of - Aegon You Need To Know

Tax Court decisions involving sensible payment. But first, we'll cover some required background details. In basic, the easiest, best way to avoid double taxed dividends is to make deductible compensation payments to shareholder-employees and deductible payments for fringe advantages for those people. As long as such payments pass the reasonable payment test, they can be utilized to lower the corporation's yearly gross income to zero or at least to $100,000 or less, where the corporation's average federal income tax rate is far below the current 28%, 33%, 35% and 39.